Understanding the EFT Authorization Agreement: A Comprehensive Guide

In today’s digital age, Electronic Funds Transfer (EFT) has become a cornerstone of financial transactions. From paying bills to receiving salaries, EFTs offer convenience and efficiency. Central to this process is the EFT authorization agreement, a critical document that governs how these electronic transfers are managed. This article provides a comprehensive overview of the EFT authorization agreement, its components, importance, and how it impacts both businesses and consumers. Understanding the EFT authorization agreement is crucial for anyone involved in electronic transactions.

What is an EFT Authorization Agreement?

An EFT authorization agreement, also known as an electronic funds transfer authorization form, is a legally binding document that grants permission to a third party to debit or credit funds from a bank account electronically. This agreement outlines the terms and conditions under which these transactions can occur, ensuring transparency and protecting the rights of all parties involved. The EFT authorization agreement essentially sets the ground rules for electronic financial interactions.

Key Components of an EFT Authorization Agreement

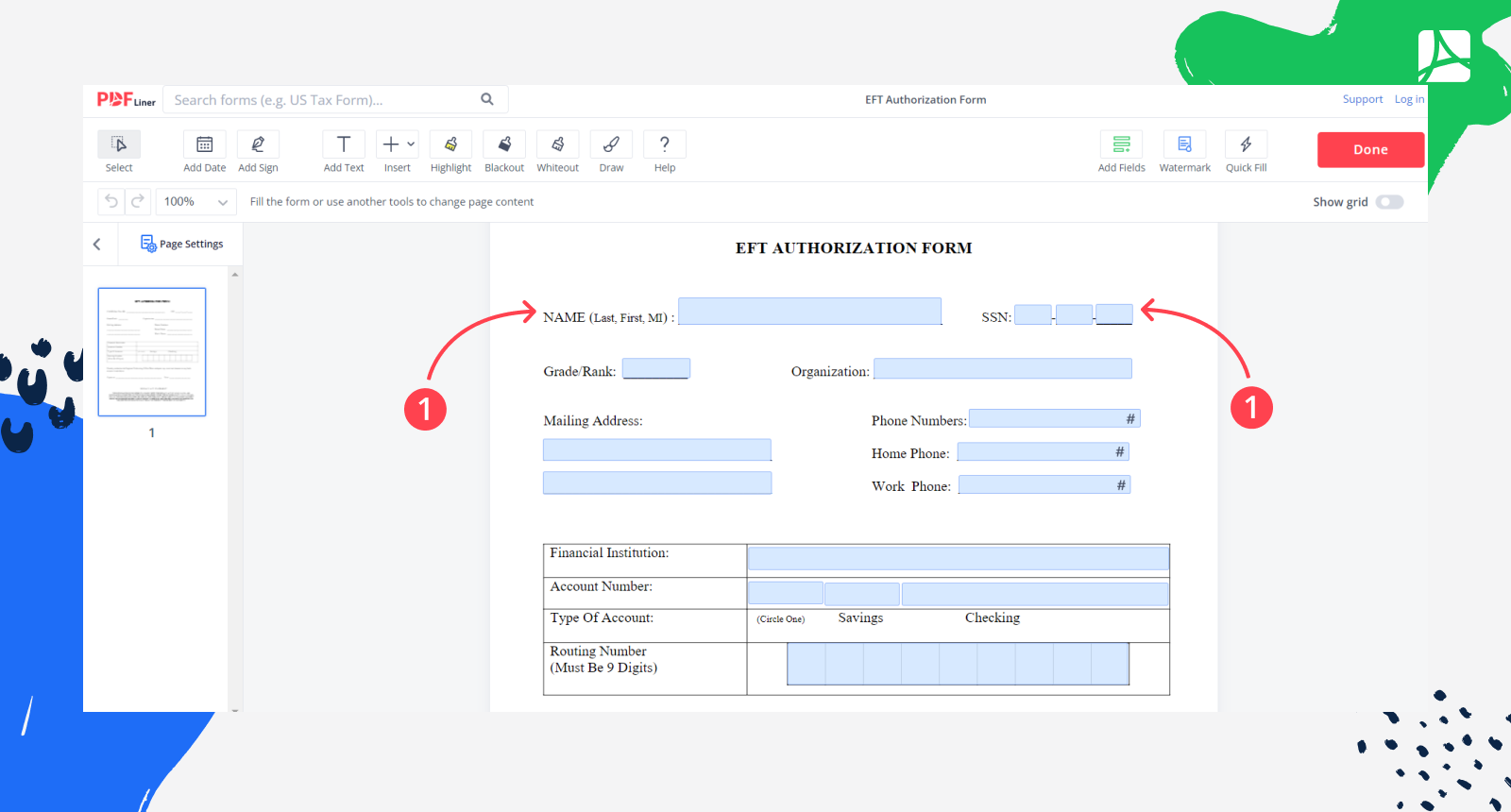

A typical EFT authorization agreement includes several essential components:

- Account Holder Information: This includes the name, address, and contact details of the person or entity authorizing the EFT.

- Bank Account Details: The agreement specifies the bank name, account number, and routing number associated with the account being debited or credited.

- Authorization Scope: This section clearly defines the purpose and scope of the authorization, such as recurring bill payments, one-time transfers, or salary deposits.

- Transaction Details: The agreement outlines the frequency, amount, and dates of the EFT transactions. For recurring payments, it specifies the schedule and any limits on the transaction amount.

- Revocation Clause: This clause explains the process for revoking the authorization, including the notice period required and the method for notifying the third party.

- Terms and Conditions: This section details the legal terms governing the agreement, including liability clauses, dispute resolution mechanisms, and applicable laws.

- Signature and Date: The agreement must be signed and dated by the account holder to signify their consent.

Why is an EFT Authorization Agreement Important?

The EFT authorization agreement serves several critical functions:

- Legal Protection: It provides legal protection for both the account holder and the third party by establishing clear terms and conditions for the EFT transactions.

- Fraud Prevention: By requiring explicit authorization, the agreement helps prevent unauthorized debits or credits from an account.

- Transparency: The agreement ensures transparency by outlining the details of the EFT transactions, including the amount, frequency, and purpose.

- Dispute Resolution: In case of disputes, the agreement serves as a reference point for resolving issues related to unauthorized transactions or incorrect amounts.

- Compliance: Adhering to EFT authorization requirements helps businesses comply with relevant regulations, such as the Electronic Fund Transfer Act (EFTA) in the United States.

Types of EFT Authorization Agreements

EFT authorization agreements can be categorized based on their purpose and scope:

Recurring Payment Authorization

This type of agreement authorizes a third party to debit funds from an account on a recurring basis, such as for monthly subscriptions, utility bills, or loan payments. The agreement specifies the frequency, amount, and duration of the recurring payments. Businesses often use recurring EFT authorization agreements to streamline billing processes and ensure timely payments.

One-Time Payment Authorization

This agreement authorizes a one-time debit or credit from an account. It is typically used for single transactions, such as online purchases or invoice payments. The agreement specifies the amount and date of the one-time transfer. Consumers often encounter one-time EFT authorization agreements when making online purchases using their bank accounts.

Payroll Direct Deposit Authorization

This agreement authorizes an employer to deposit an employee’s salary directly into their bank account. It specifies the employee’s account details, the frequency of the deposits, and any deductions to be made. Payroll direct deposit authorization simplifies payroll processes and ensures timely payment of wages. Employees benefit from the convenience of receiving their paychecks directly into their accounts.

EFT Authorization Agreement Best Practices

To ensure the effectiveness and validity of an EFT authorization agreement, consider the following best practices:

- Obtain Written Authorization: Always obtain written authorization from the account holder before initiating any EFT transactions. This provides a clear record of consent and helps prevent disputes.

- Clearly Define the Terms: Ensure that the terms and conditions of the agreement are clearly defined and easily understood by the account holder. Avoid using ambiguous language or technical jargon.

- Provide a Copy to the Account Holder: Provide a copy of the signed agreement to the account holder for their records. This allows them to refer to the terms of the agreement and track their EFT transactions.

- Securely Store the Agreement: Store the signed agreement in a secure location to protect the account holder’s personal and financial information. Implement appropriate security measures to prevent unauthorized access or disclosure.

- Comply with Regulations: Ensure that the agreement complies with all relevant regulations, such as the Electronic Fund Transfer Act (EFTA) and the rules of the National Automated Clearing House Association (NACHA).

- Regularly Review and Update: Regularly review and update the agreement to reflect changes in regulations, business practices, or account holder preferences.

The Electronic Fund Transfer Act (EFTA)

The Electronic Fund Transfer Act (EFTA) is a federal law in the United States that protects consumers engaging in electronic fund transfers. The EFTA establishes rights and responsibilities for both consumers and financial institutions regarding EFTs. Key provisions of the EFTA include:

- Disclosure Requirements: Financial institutions must disclose the terms and conditions of EFT services to consumers, including fees, liability for unauthorized transfers, and error resolution procedures.

- Error Resolution Procedures: The EFTA outlines procedures for resolving errors related to EFTs, including the timeframes for investigating and resolving disputes.

- Liability for Unauthorized Transfers: Consumers are protected from liability for unauthorized EFTs if they report the loss or theft of their access device (e.g., debit card, PIN) in a timely manner.

- Preauthorized Transfers: The EFTA requires written authorization for preauthorized EFTs, such as recurring payments, and allows consumers to stop payment of these transfers.

NACHA Operating Rules

The National Automated Clearing House Association (NACHA) is a non-profit organization that governs the ACH Network, which is the primary system for processing EFTs in the United States. NACHA develops and enforces the NACHA Operating Rules, which establish standards and procedures for ACH transactions. Key aspects of the NACHA Operating Rules include:

- Authorization Requirements: The rules specify the requirements for obtaining authorization for ACH transactions, including the form and content of the authorization agreement.

- Data Security Standards: The rules establish data security standards for protecting sensitive information transmitted through the ACH Network.

- Risk Management Procedures: The rules outline risk management procedures for preventing and detecting fraud and other unauthorized activities.

- Compliance Requirements: The rules require participants in the ACH Network to comply with all applicable laws and regulations, including the EFTA.

EFT Authorization Agreement in Business Operations

For businesses, implementing robust EFT authorization processes is essential for efficient and secure financial transactions. Here are some considerations for businesses:

- Streamlining Payment Processes: EFT authorization agreements can streamline payment processes by automating recurring payments and reducing the need for manual invoicing and check processing.

- Reducing Fraud Risk: By requiring explicit authorization for EFT transactions, businesses can reduce the risk of fraud and unauthorized debits.

- Improving Customer Satisfaction: Offering EFT payment options can improve customer satisfaction by providing a convenient and efficient payment method.

- Ensuring Regulatory Compliance: Adhering to EFT authorization requirements helps businesses comply with relevant regulations and avoid penalties.

- Maintaining Accurate Records: Maintaining accurate records of EFT authorization agreements is essential for auditing and dispute resolution purposes.

Common Mistakes to Avoid

When dealing with EFT authorization agreements, it’s crucial to avoid common mistakes that can lead to legal or financial complications:

- Failing to Obtain Written Authorization: Always obtain written authorization before initiating EFT transactions. Verbal authorization is not sufficient and can lead to disputes.

- Using Ambiguous Language: Use clear and concise language in the agreement to avoid misunderstandings. Avoid using technical jargon or ambiguous terms.

- Not Providing a Copy to the Account Holder: Always provide a copy of the signed agreement to the account holder for their records.

- Not Securely Storing the Agreement: Store the signed agreement in a secure location to protect the account holder’s personal and financial information.

- Ignoring Regulatory Requirements: Ensure that the agreement complies with all relevant regulations, such as the EFTA and the NACHA Operating Rules.

- Not Regularly Reviewing and Updating: Regularly review and update the agreement to reflect changes in regulations, business practices, or account holder preferences.

The Future of EFT Authorization Agreements

As technology continues to evolve, the future of EFT authorization agreements is likely to be shaped by several key trends:

- Digital Authorization: The shift towards digital authorization methods, such as e-signatures and online consent forms, will continue to gain momentum.

- Mobile Payments: The increasing popularity of mobile payments will drive the need for mobile-friendly EFT authorization processes.

- Enhanced Security: Enhanced security measures, such as multi-factor authentication and biometric verification, will be implemented to protect against fraud and unauthorized transactions.

- Real-Time Payments: The rise of real-time payments will require faster and more efficient EFT authorization processes.

- Blockchain Technology: Blockchain technology could potentially be used to create secure and transparent EFT authorization systems.

Conclusion

The EFT authorization agreement is a fundamental document in the world of electronic financial transactions. It provides legal protection, prevents fraud, ensures transparency, and facilitates dispute resolution. By understanding the key components of an EFT authorization agreement, adhering to best practices, and complying with relevant regulations, both businesses and consumers can navigate the complexities of electronic fund transfers with confidence. As technology continues to advance, the EFT authorization agreement will likely evolve to meet the changing needs of the digital economy. Understanding the EFT authorization agreement is not just about compliance; it’s about fostering trust and security in the digital financial landscape. Businesses should prioritize clear communication and secure processes when handling EFT authorization agreements. Consumers should take the time to carefully review and understand any EFT authorization agreement before signing it. The EFT authorization agreement is a vital tool for managing your finances safely and effectively. Don’t underestimate the importance of a well-drafted EFT authorization agreement. A solid EFT authorization agreement can save you time, money, and headaches in the long run. Make sure your EFT authorization agreement is up to date and compliant with all relevant regulations. Review your EFT authorization agreement regularly to ensure it still meets your needs. A properly executed EFT authorization agreement is a cornerstone of secure electronic transactions. The EFT authorization agreement process should be seamless and easy to understand for all parties involved. For any business handling EFT authorization agreements, security and compliance are paramount. When in doubt, consult with a legal professional regarding your EFT authorization agreement. The EFT authorization agreement is a key element in maintaining financial integrity in electronic transactions. [See also: Understanding ACH Transfers] and [See also: Electronic Payment Systems].