Understanding the BCBS Settlement: How Much Is It and Who Is Affected?

The Blue Cross Blue Shield (BCBS) settlement has been a significant topic of discussion in the healthcare industry. Many individuals and businesses are keen to understand the details, particularly regarding the financial aspects. The core question remains: how much is the BCBS settlement, and who exactly benefits from it? This article aims to provide a comprehensive overview, clarifying the settlement amount, the beneficiaries, and the broader implications for the healthcare market.

Background of the BCBS Antitrust Lawsuit

The BCBS settlement stems from a long-standing antitrust lawsuit filed against the Blue Cross Blue Shield Association and its member companies. The lawsuit alleged that BCBS engaged in anticompetitive practices that limited competition among its licensees, thereby driving up healthcare costs for consumers and employers. The plaintiffs argued that the association’s rules restricted each BCBS company to specific geographic areas, preventing them from competing with each other and suppressing innovation.

The core of the complaint revolved around the assertion that the BCBS Association’s licensing agreements created exclusive territories for each BCBS company. This meant that a BCBS plan in one state couldn’t directly compete with a BCBS plan in another. Plaintiffs claimed this arrangement artificially inflated prices and reduced the range of choices available to consumers and employers seeking health insurance coverage. [See also: The Impact of Healthcare Consolidation on Premiums]

The Settlement Amount: A Detailed Breakdown

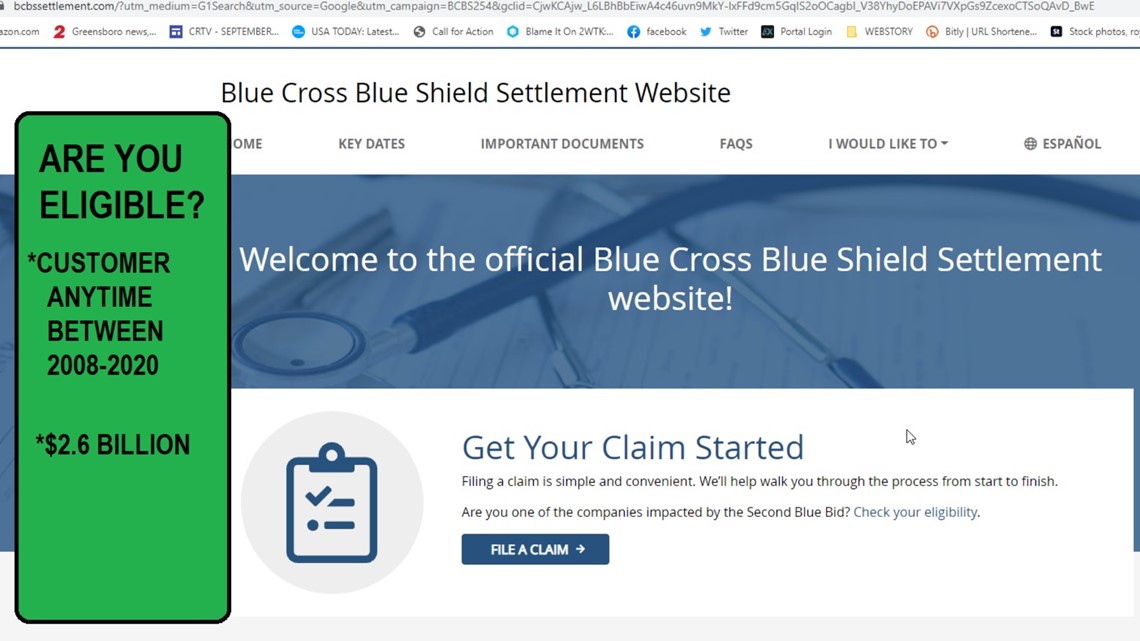

So, how much is the BCBS settlement? The final settlement agreement reached a total of $2.67 billion. This considerable sum is intended to compensate individuals and businesses who purchased or were covered by Blue Cross Blue Shield health insurance plans during the class period, which generally spans from 2008 to 2020. However, it’s crucial to understand that this total amount is not distributed equally; the actual amount received by each claimant will vary based on several factors.

Allocation of Funds

The settlement funds are allocated among different classes of claimants, primarily based on the type of insurance coverage they had and the period during which they were covered. The process involves complex calculations to determine individual and group shares. Factors influencing the payout amount include:

- The type of BCBS health insurance plan (e.g., individual, small group, large group).

- The duration of coverage during the class period (2008-2020).

- The amount of premiums paid.

It’s important to note that administrative costs, legal fees, and other expenses are deducted from the total settlement amount before distributions are made to the class members. These deductions, while necessary for the administration of the settlement, do reduce the net amount available for distribution.

Who Is Eligible for the BCBS Settlement?

Determining eligibility for the BCBS settlement involves specific criteria. Generally, individuals and businesses who purchased or were covered by a Blue Cross Blue Shield health insurance plan between 2008 and 2020 are potentially eligible. However, certain exceptions and exclusions apply. Key eligibility requirements include:

- Having purchased or been covered by a BCBS health insurance plan during the class period.

- Not being excluded from the class (e.g., certain government entities or large self-funded employers).

- Submitting a valid claim form by the specified deadline.

It’s crucial for potential claimants to review the official settlement website or consult with legal counsel to confirm their eligibility and understand the specific requirements for filing a claim. The claims process typically involves providing documentation to verify coverage and premium payments.

The Claims Process: How to File for Compensation

Filing a claim for the BCBS settlement requires careful attention to detail and adherence to the established procedures. The claims process generally involves the following steps:

- Reviewing the Settlement Notice: Potential claimants should carefully review the official settlement notice, which provides detailed information about the settlement terms, eligibility criteria, and claims process.

- Completing the Claim Form: Claimants must complete a claim form, providing accurate information about their BCBS health insurance coverage and premium payments.

- Gathering Supporting Documentation: Claimants should gather supporting documentation, such as insurance cards, policy documents, and premium payment records, to verify their coverage and premium amounts.

- Submitting the Claim Form: The completed claim form and supporting documentation must be submitted by the specified deadline, typically through the settlement website or by mail.

It’s essential to adhere to the deadlines and provide complete and accurate information to ensure that the claim is processed correctly. Claimants should also keep a copy of their claim form and supporting documentation for their records. [See also: Navigating the Healthcare Claims Process]

Impact on the Healthcare Market

Beyond the direct financial compensation to claimants, the BCBS settlement has broader implications for the healthcare market. The settlement agreement includes provisions aimed at promoting competition among BCBS companies and fostering innovation in the health insurance industry.

These provisions may include:

- Relaxing restrictions on BCBS companies competing outside their designated territories.

- Encouraging BCBS companies to offer more diverse and innovative health insurance products.

- Increasing transparency in pricing and contracting practices.

The long-term effects of these changes remain to be seen, but they have the potential to create a more competitive and consumer-friendly healthcare market. By addressing anticompetitive practices, the settlement aims to lower healthcare costs, increase consumer choice, and drive innovation in the health insurance industry.

Future Implications and Ongoing Monitoring

The BCBS settlement represents a significant step toward addressing anticompetitive practices in the health insurance industry. However, ongoing monitoring and enforcement are crucial to ensure that the settlement terms are fully implemented and that the intended benefits are realized.

Regulators and consumer advocacy groups will likely continue to scrutinize the behavior of BCBS companies to ensure compliance with the settlement agreement and to identify any new anticompetitive practices that may emerge. The settlement also serves as a reminder of the importance of antitrust enforcement in protecting consumers and promoting competition in the healthcare market.

Expert Opinions and Analysis

Industry experts have offered various perspectives on the BCBS settlement. Some view it as a landmark victory for consumers and a significant deterrent to anticompetitive behavior in the health insurance industry. Others express concerns about the potential limitations of the settlement and the challenges of effectively monitoring compliance.

Legal analysts note that the settlement could pave the way for similar antitrust actions against other large health insurance companies. Economists emphasize the importance of promoting competition to drive down healthcare costs and improve access to quality care.

Overall, the consensus is that the BCBS settlement is a positive development, but ongoing vigilance and proactive enforcement are necessary to ensure that its intended benefits are fully realized. The question of how much is the BCBS settlement is only one piece of a much larger puzzle. [See also: The Future of Healthcare Regulation]

Conclusion: Understanding the Scope of the BCBS Settlement

In conclusion, the BCBS settlement, totaling $2.67 billion, represents a significant effort to address anticompetitive practices in the health insurance industry. While the question of how much is the BCBS settlement is important, it’s equally crucial to understand who is eligible, how to file a claim, and the broader implications for the healthcare market. The settlement aims to compensate individuals and businesses affected by BCBS’s alleged anticompetitive behavior and to foster a more competitive and consumer-friendly healthcare environment. Potential claimants should carefully review the settlement terms and file their claims by the specified deadline to ensure they receive the compensation they are entitled to. The BCBS settlement is a complex issue with far-reaching consequences, and understanding its nuances is essential for anyone involved in the healthcare industry.

Understanding how much is the BCBS settlement requires delving into the specifics of eligibility, claim processes, and the larger market impact. The settlement attempts to rectify past issues and pave the way for a more competitive future. The amount each claimant receives will vary, but the overall goal is to provide restitution for those affected by the alleged anti-competitive practices. Remember to consult official resources and legal counsel for personalized guidance on your eligibility and claim process. The impact of how much is the BCBS settlement extends beyond individual payouts, influencing the competitive landscape of health insurance.

The significance of how much is the BCBS settlement cannot be overstated. It’s a substantial figure representing years of alleged anticompetitive behavior. Individuals and businesses alike need to understand the implications and take appropriate action to claim their share. The how much is the BCBS settlement question is just the beginning; the real work lies in ensuring fair distribution and fostering a more competitive healthcare market.