Understanding Homeowners Association (HOA) Dues: What You Need to Know

Homeowners Association (HOA) dues are a common aspect of living in many planned communities, condominiums, and townhome developments across the United States. These fees, typically collected monthly or annually, fund the maintenance, operations, and improvements of shared community amenities and services. Understanding what homeowners association dues cover, how they are determined, and the potential implications of non-payment is crucial for anyone considering purchasing property within an HOA. This comprehensive guide aims to provide a clear and objective overview of HOA dues, offering valuable insights for both prospective and current homeowners.

What are Homeowners Association Dues?

Homeowners association dues, also known as assessments, are mandatory payments required of all property owners within a community governed by an HOA. These dues are used to cover a wide range of expenses, ensuring the upkeep and smooth functioning of the community. The specific services and amenities covered by HOA dues can vary significantly depending on the community’s size, location, and the amenities it offers.

Common Expenses Covered by HOA Dues

- Common Area Maintenance: This includes landscaping, snow removal, and upkeep of shared spaces like parks, playgrounds, and walking trails.

- Building Maintenance: In condominiums and townhomes, HOA dues often cover the maintenance and repair of exterior building components, such as roofs, siding, and foundations.

- Amenities: Many HOAs offer amenities like swimming pools, fitness centers, clubhouses, and tennis courts. Homeowners association dues contribute to the upkeep and operation of these facilities.

- Insurance: HOAs typically carry insurance policies to cover common areas and building exteriors. A portion of HOA dues goes towards these insurance premiums.

- Utilities: In some communities, HOA dues may cover utilities like water, sewer, and trash removal for all residents.

- Management Fees: HOAs often hire professional management companies to handle administrative tasks, financial management, and community governance. Homeowners association dues cover the cost of these services.

- Reserve Funds: A portion of HOA dues is typically allocated to a reserve fund, which is used to cover major repairs and replacements of common area assets in the future.

How are HOA Dues Determined?

The process of determining homeowners association dues involves careful budgeting and planning by the HOA board of directors. The board is responsible for assessing the community’s financial needs and setting dues at a level that will adequately cover expenses. Here’s a breakdown of the key steps involved:

Budget Preparation

The HOA board, often with the assistance of a professional management company, prepares an annual budget that outlines all anticipated expenses for the upcoming year. This budget includes line items for all the expenses listed above, as well as any other costs associated with operating the community. [See also: HOA Budgeting Best Practices]

Reserve Study

A reserve study is a comprehensive assessment of the community’s common area assets and their remaining useful life. The study estimates the cost of future repairs and replacements, allowing the HOA to plan for these expenses and allocate sufficient funds to the reserve account. A well-funded reserve account is crucial for avoiding special assessments, which are one-time fees levied on homeowners to cover unexpected or major expenses.

Allocation of Expenses

Once the budget is prepared, the HOA board determines how to allocate the expenses among homeowners. In most cases, homeowners association dues are assessed equally to all property owners. However, some HOAs may use a different allocation method, such as assigning dues based on the square footage of the property or the value of the home.

Approval and Notification

The proposed budget and homeowners association dues are typically presented to the homeowners for review and approval at an annual meeting. Once approved, the HOA provides homeowners with a notification of the new dues amount and the payment schedule.

The Impact of HOA Dues on Homeowners

Homeowners association dues can have a significant impact on a homeowner’s budget and overall cost of living. While they provide valuable services and amenities, it’s important to carefully consider the financial implications before purchasing property in an HOA. Here are some key points to keep in mind:

Budgeting for HOA Dues

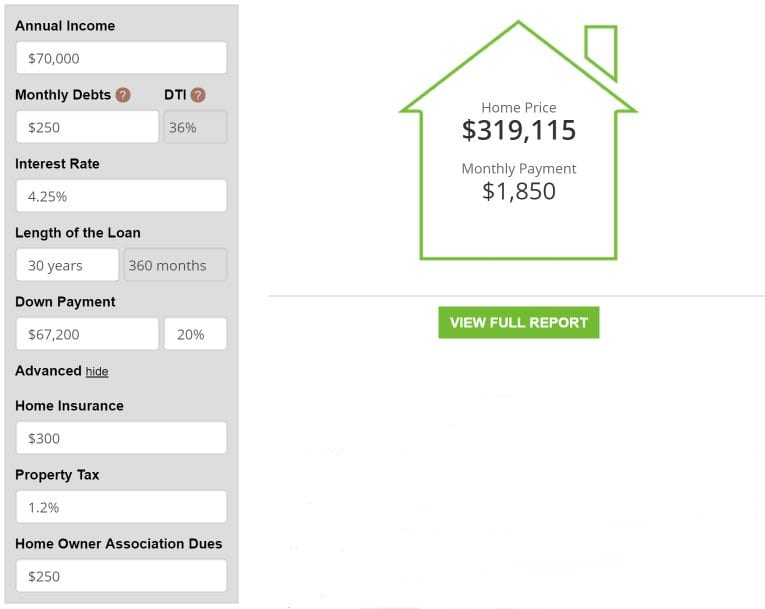

When budgeting for a home purchase, be sure to factor in homeowners association dues in addition to your mortgage payment, property taxes, and insurance. These dues can represent a substantial monthly expense, so it’s important to understand the amount and what it covers.

Potential for Increases

Homeowners association dues are not fixed and can increase over time due to rising costs of maintenance, insurance, and other expenses. It’s important to review the HOA’s budget and financial statements to understand the potential for future increases. Ask about the HOA’s history of dues increases and its plans for addressing future financial challenges.

Special Assessments

As mentioned earlier, special assessments are one-time fees levied on homeowners to cover unexpected or major expenses. These assessments can be a significant financial burden, so it’s important to understand the HOA’s reserve fund and its ability to cover future expenses without resorting to special assessments. [See also: Avoiding Special Assessments in Your HOA]

Impact on Property Values

While homeowners association dues represent an added expense, they can also contribute to higher property values. A well-maintained community with attractive amenities can be more desirable to potential buyers, leading to increased demand and higher prices. However, excessively high HOA dues can also deter buyers, so it’s important to find a balance.

What Happens if You Don’t Pay HOA Dues?

Failure to pay homeowners association dues can have serious consequences. HOAs have the legal authority to take action against homeowners who are delinquent in their payments. The specific consequences of non-payment can vary depending on the HOA’s governing documents and state laws, but here are some common repercussions:

Late Fees and Interest

HOAs typically charge late fees and interest on overdue homeowners association dues. These fees can quickly add up, making it even more difficult to catch up on payments.

Loss of Amenities

Many HOAs have the authority to suspend a homeowner’s access to community amenities, such as swimming pools and fitness centers, if they are delinquent in their HOA dues payments.

Liens and Foreclosure

In most states, HOAs have the right to place a lien on a homeowner’s property for unpaid homeowners association dues. A lien is a legal claim against the property that can ultimately lead to foreclosure if the debt is not paid. Foreclosure is a legal process in which the HOA can take ownership of the property and sell it to recover the unpaid dues.

Legal Action

HOAs can also pursue legal action against homeowners to collect unpaid homeowners association dues. This can involve filing a lawsuit and obtaining a judgment against the homeowner, which can further damage their credit rating.

Tips for Managing HOA Dues

Managing homeowners association dues effectively is crucial for maintaining a healthy financial situation and avoiding potential problems. Here are some tips for homeowners:

- Pay on Time: The easiest way to avoid late fees and other penalties is to pay your HOA dues on time, every time. Set up automatic payments if possible to ensure you never miss a deadline.

- Review the Budget: Take the time to review the HOA’s budget and financial statements to understand how your homeowners association dues are being used. This can help you identify potential areas of concern and ask informed questions at HOA meetings.

- Attend HOA Meetings: Attending HOA meetings is a great way to stay informed about community issues and participate in the decision-making process. You can voice your concerns about HOA dues, propose alternative solutions, and help shape the future of your community.

- Communicate with the HOA: If you are experiencing financial difficulties and are unable to pay your homeowners association dues on time, communicate with the HOA management company or board of directors. They may be willing to work with you on a payment plan or offer other assistance.

- Understand Your Rights: Familiarize yourself with your rights as a homeowner under the HOA’s governing documents and state laws. This can help you protect your interests and ensure that the HOA is acting fairly and responsibly.

Conclusion

Homeowners association dues are an integral part of living in many planned communities. Understanding what these dues cover, how they are determined, and the potential implications of non-payment is essential for both prospective and current homeowners. By carefully considering the financial implications, actively participating in the HOA, and managing your HOA dues effectively, you can enjoy the benefits of community living while protecting your financial well-being. Always remember to review the HOA documents thoroughly before purchasing a property and to stay informed about community issues and financial matters. This proactive approach will contribute to a positive and sustainable living experience within your HOA community.