Chase Sapphire Preferred: A Comprehensive Review for 2024

The Chase Sapphire Preferred card is a popular travel rewards credit card known for its valuable points, flexible redemption options, and reasonable annual fee. In this comprehensive review, we’ll delve into the card’s benefits, drawbacks, and overall suitability for different types of travelers in 2024. Whether you’re a seasoned globetrotter or just starting to explore the world of travel rewards, understanding the Chase Sapphire Preferred card’s features is crucial for making an informed decision. We’ll examine its earning potential, bonus categories, redemption options, and compare it against other travel credit cards to help you determine if it’s the right fit for your needs. This review will cover everything you need to know about the Chase Sapphire Preferred card.

Earning Rewards with the Chase Sapphire Preferred

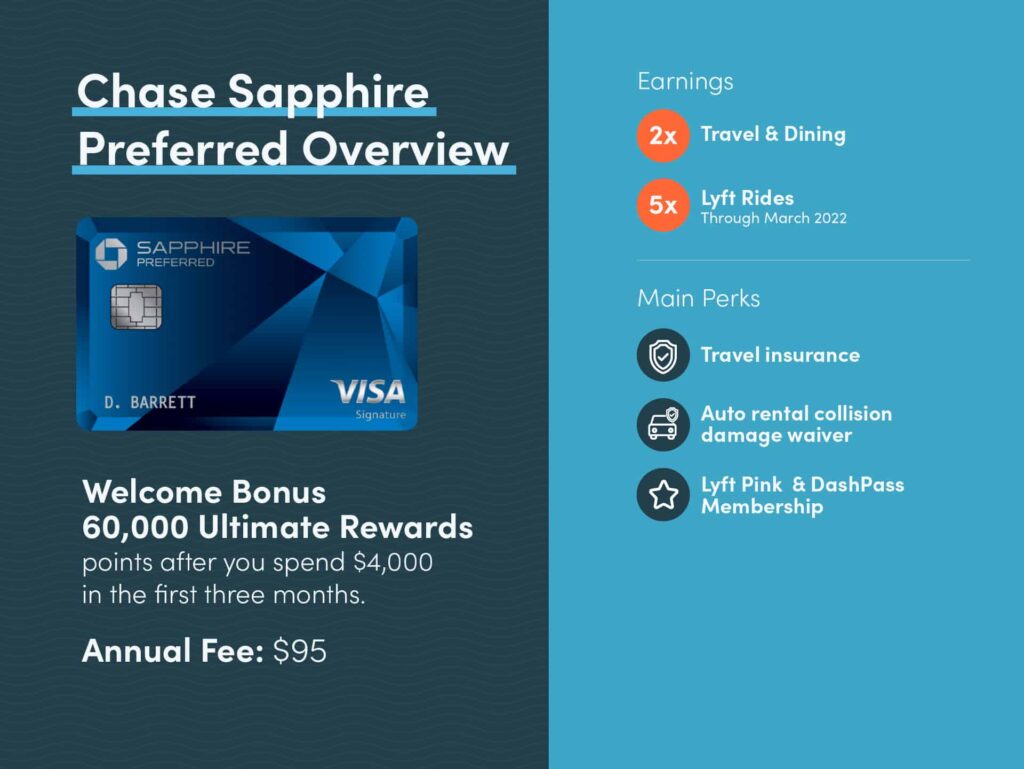

The Chase Sapphire Preferred card earns Chase Ultimate Rewards points, which are highly valued due to their flexibility. The card offers a strong earning structure, making it attractive to those who spend frequently in specific categories.

Bonus Categories

- Dining: Earn 3x points on dining at restaurants worldwide, including eligible delivery services and takeout.

- Travel: Earn 2x points on travel purchases, including airfare, hotels, rental cars, taxis, and tolls.

- Online Grocery Purchases: Earn 3x points on online grocery purchases (excluding Target, Walmart and wholesale clubs).

- Select Streaming Services: Earn 3x points on select streaming services.

- Other Purchases: Earn 1x point on all other purchases.

These bonus categories make the Chase Sapphire Preferred a valuable card for everyday spending, especially if you dine out frequently or travel regularly. The 3x points on dining and the 2x points on travel can quickly add up, maximizing your rewards earnings.

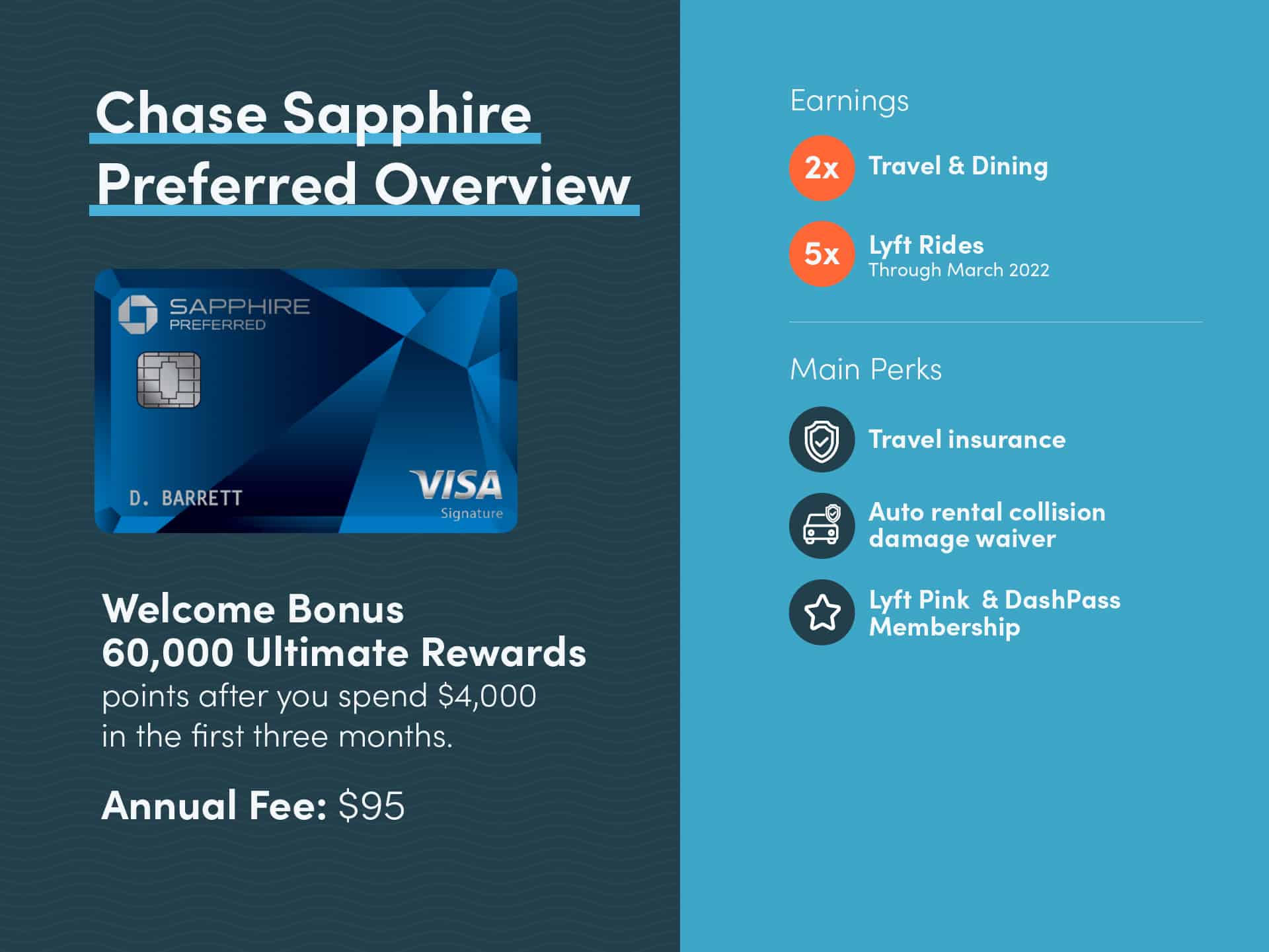

Welcome Bonus

The Chase Sapphire Preferred often features a generous welcome bonus for new cardholders who meet a minimum spending requirement within the first few months of account opening. This bonus can be worth hundreds of dollars in travel or cash back, making it a significant incentive to apply for the card. Be sure to check the latest offer on the Chase website, as it can change periodically. The current welcome bonus usually involves earning a substantial number of bonus points after spending a specific amount within the first three months.

Redeeming Chase Ultimate Rewards Points

One of the biggest advantages of the Chase Sapphire Preferred card is the flexibility of redeeming Chase Ultimate Rewards points. There are several options available, allowing you to choose the redemption method that best suits your needs.

Travel Portal

You can redeem your points for travel through the Chase Ultimate Rewards travel portal, where points are worth 1.25 cents each. This means that 10,000 points are worth $125 in travel. The portal allows you to book flights, hotels, rental cars, and activities, providing a convenient way to use your points for your travel plans.

Transfer Partners

Chase Ultimate Rewards points can be transferred to a variety of airline and hotel partners, often at a 1:1 ratio. This can be a more valuable redemption option than using the travel portal, especially if you can find award availability and maximize the value of your points. Some of Chase’s most popular transfer partners include United Airlines, Hyatt, and Southwest Airlines. Transferring to partners can unlock significantly greater value from your points, sometimes exceeding 2 cents per point or more. [See also: Maximizing Chase Ultimate Rewards Points]

Cash Back

You can also redeem your points for cash back, typically at a rate of 1 cent per point. While this is a straightforward option, it generally offers less value than redeeming for travel through the portal or transferring to partners. However, it can be a useful option if you need cash or want to offset your credit card statement balance.

Gift Cards

Chase also allows you to redeem points for gift cards from various retailers and restaurants. The redemption rate for gift cards can vary, so it’s important to compare the value against other redemption options before making a decision.

Benefits and Perks of the Chase Sapphire Preferred

Beyond the earning and redemption options, the Chase Sapphire Preferred card offers several other benefits and perks that can enhance your travel experience and provide peace of mind.

Travel Insurance

The card includes a variety of travel insurance benefits, such as trip cancellation/interruption insurance, baggage delay insurance, and auto rental collision damage waiver. These benefits can protect you against unexpected events and save you money on travel-related expenses. Trip cancellation/interruption insurance can reimburse you for non-refundable travel expenses if your trip is canceled or interrupted due to covered reasons. Baggage delay insurance can reimburse you for essential items if your luggage is delayed. The auto rental collision damage waiver can cover damage to a rental car, saving you from having to purchase additional insurance from the rental company.

Purchase Protection

The Chase Sapphire Preferred offers purchase protection, which can cover eligible purchases against damage or theft for a certain period of time. This can provide peace of mind when making purchases with your card, knowing that you’re protected against unexpected events. This protection usually extends for 120 days from the date of purchase.

Extended Warranty Protection

The card also offers extended warranty protection, which can extend the manufacturer’s warranty on eligible purchases. This can be a valuable benefit for expensive electronics or appliances, providing additional coverage beyond the original warranty period. Typically, the extended warranty adds an additional year to warranties of three years or less.

No Foreign Transaction Fees

The Chase Sapphire Preferred does not charge foreign transaction fees, making it an excellent choice for international travel. This can save you a significant amount of money on purchases made abroad.

Annual Fee and Other Considerations

The Chase Sapphire Preferred card has an annual fee, which is important to consider when evaluating the card’s overall value. However, the card’s benefits and rewards can often outweigh the annual fee, especially for frequent travelers and those who maximize the bonus categories. It’s crucial to assess your spending habits and travel patterns to determine if the card’s benefits justify the annual fee.

Credit Score Requirements

The Chase Sapphire Preferred typically requires a good to excellent credit score for approval. This means you’ll likely need a FICO score of 670 or higher to be considered. Before applying, it’s a good idea to check your credit score and review your credit report to ensure there are no errors or issues that could affect your approval chances.

5/24 Rule

Chase has a rule known as the 5/24 rule, which states that you will not be approved for a Chase card if you have opened five or more credit cards (from any bank) in the past 24 months. This is an important consideration if you’ve been actively applying for credit cards recently.

Chase Sapphire Preferred vs. Chase Sapphire Reserve

The Chase Sapphire Preferred is often compared to its more premium sibling, the Chase Sapphire Reserve. While both cards offer valuable rewards and benefits, there are some key differences to consider.

Annual Fee

The Chase Sapphire Reserve has a higher annual fee than the Chase Sapphire Preferred. This is a significant factor to consider when deciding which card is right for you.

Redemption Bonus

The Chase Sapphire Reserve offers a higher redemption bonus when redeeming points through the Chase Ultimate Rewards travel portal. Points are worth 1.5 cents each, compared to 1.25 cents for the Chase Sapphire Preferred.

Travel Credit

The Chase Sapphire Reserve offers an annual travel credit, which can help offset the annual fee. This is a valuable benefit for frequent travelers.

Earning Rates

The Chase Sapphire Reserve offers higher earning rates on certain categories, such as travel and dining. This can make it a more rewarding card for those who spend heavily in these areas. The Reserve earns 3x points on travel and dining worldwide, while the Chase Sapphire Preferred earns 3x on dining and 2x on travel.

Lounge Access

The Chase Sapphire Reserve offers complimentary access to Priority Pass airport lounges, providing a more comfortable and convenient travel experience. This is a significant perk for frequent flyers.

Is the Chase Sapphire Preferred Right for You?

The Chase Sapphire Preferred is a valuable travel rewards credit card that offers a strong combination of earning potential, flexible redemption options, and valuable benefits. It’s a great choice for those who want to earn rewards on travel and dining purchases and enjoy travel insurance benefits without paying a high annual fee. However, it’s important to consider your spending habits, travel patterns, and credit score before applying. If you’re looking for a more premium travel credit card with additional benefits, the Chase Sapphire Reserve may be a better option. [See also: Best Travel Credit Cards of 2024]

Ultimately, the best credit card for you depends on your individual needs and preferences. By carefully evaluating the Chase Sapphire Preferred card’s features and comparing it against other options, you can make an informed decision and choose the card that best suits your lifestyle.

Conclusion

The Chase Sapphire Preferred remains a top contender in the travel rewards credit card market in 2024. Its balanced approach to rewards, benefits, and annual fee makes it an appealing option for a wide range of consumers. By understanding its strengths and weaknesses, you can determine if it’s the right card to help you achieve your travel goals. The Chase Sapphire Preferred card provides a great entry point into the world of travel rewards.